To provide speedy disposal of offences punishable under the Companies Act, 2013, which are punishable with imprisonment of 2 years or more, the Ministry of Corporate Affairs has notified the provisions dealing with ‘Special Courts’ with effect from 18 May 2016. The intention behind setting up these courts is to let magistrate courts try minor violations, and that graver offences should be dealt by Special Courts.

SPECIAL COURTS DESIGNATED

Existing courts in the State of Maharashtra, Jammu and Kashmir, Goa, Gujarat, Madhya Pradesh, West Bengal, and Union territory of Andaman and Nicobar Islands, and Dadra and Nagar Haveli and Daman and Diu, have been designated as Special Courts for the purposes of trying offences under the Companies Act, 2013. As per the notification, these courts have been designated for the purposes of trial of offences punishable under the Companies Act, 2013 with imprisonment of 2 years or more.

OFFENCES TRIABLE BY SPECIAL COURTS

As per the provisions of the Companies Act, 2013, following offences are triable by Special Courts:

(i) Offences for which the Companies Act, 2013, provides for imprisonment of 2 years or more;

(ii) Cases forwarded by a Magistrate (where he thinks detention is unnecessary) for any offence committed under the Companies Act, 2013. This provision will come into play when a person is arrested and detained in custody, and it appears that the investigation cannot be completed within the period of 24 hours as required under the Code of Criminal Procedure, 1973 (CrPC) and there are grounds for believing that the accusation or information is well-founded, and detention is authorized by Magistrate for a period not exceeding 15 days (if ordered by Judicial Magistrate) or 7 days (if ordered by Executive Magistrate), as the case may be. In such cases, the Special Court has the same power as the Magistrate having jurisdiction to try such case;

(iii) take cognizance of an offence under the Companies Act, 2013, without the accused being committed to it for trial upon: (a) perusal of the police report of the facts constituting such offence, or (b) if a complaint has been filed in that behalf;

(iv) try at the same trial an offence for which an accused may be charged under CrPC in addition to an offence under the Companies Act, 2013;

(v) if the Special Court thinks fit, it may try in a summary way, any offence under the Companies Act, 2013, which is punishable with imprisonment for a term not exceeding 3 years, provided that in the case of any conviction in such trial, person cannot be sentenced for imprisonment for a term exceeding 1 year.

APPEAL/REVISIONS FROM SPECIAL COURTS TO HIGH COURTS

Notably, for the purposes of entertaining appeal and revision, the High Court have been granted jurisdiction, as if the Special Court within the local limits of the jurisdiction of the High Court were a Court of Session trying cases within the local limits of the jurisdiction of the High Court.

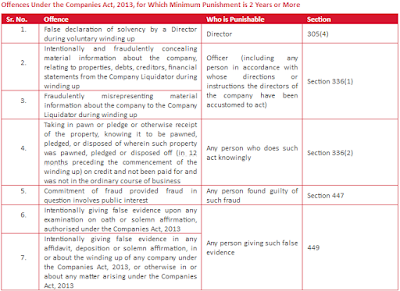

Offences Under the Companies Act, 2013, for Which Minimum Punishment is 2 Years or More

(Click to View)

Disclaimer: The information provided in this update is intended for informational purposes only and does not constitute legal opinion or advice. Readers are requested to seek formal legal advice prior to acting upon any of the information provided herein. This update is not intended to address the circumstances of any particular individual or corporate body. There can be no assurance that the judicial/ quasi judicial authorities may not take a position contrary to the views mentioned herein.

Venture Intelligence is India's longest serving provider of data and analysis on Private Company Financials, Transactions (private equity, venture capital and M&A) & their Valuations in India.

Click Here to Sign Up for the FREE Weekly Edition of the Deal Digest: India's First & Most Exhaustive Transactions Newsletter.