Private Equity exits in India for Q1 2016 amounted to $2.5 billion (including value of stock swap transactions) an increase of 129% compared to $1.94 billion in the Q1 2015, according to latest Venture Intelligence Private Equity Exits Report. Of the total exit value in Q1’16, $2 billion represented complete exits; the remainder being partial ones.

Highlights

The largest PE exit announced (in value terms) during the year was the stake sale worth $1.05 billion of Alliance Tire Group by KKR to Yokohama Rubber Co. KKR realized approx. 2.8x return on its three year old investment.

The next largest was the exit by Advent International from Care Hospitals via a sale to Abraaj Group for a reported $231 million. This was followed by Arpwood Partners’ stake sale in Senvion when it got listed in Frankfurt stock exchange on Mar 23, 2016 fetching a 2x return, within a year of the investment. In the IT space investors in BillDesk and Commonfloor registered exits in deals worth $100 M+.

Exits by Profitability

In Q1 2016, PE investors fetched 32 profitable exits compared to 52 profitable exits in the previous quarter. Of these, six exits fetched 3x or higher returns (compared to 13 such deals in Q1 2015).

SAIF Partners registered a 22x return in a buyback deal in JustDial, while Sequoia Capital India also recorded a 4.6x in a buyback deal in JustDial. Rakesh Jhunjhunwala's Rare Enterprises registered a 13x exit when it sold Concordia Biotech to Quadria India.

- 7 exits of over $100 million in value account for 82.28% of the value pie

- KKR sells its stake in Alliance Tire Group for $1.05 Billion to Yokohama Rubber Co

- Strategic Sale exits at $1.3 Billion account for 37% of total exits followed by Public Market Sale and Secondary sale with 29% each

The largest PE exit announced (in value terms) during the year was the stake sale worth $1.05 billion of Alliance Tire Group by KKR to Yokohama Rubber Co. KKR realized approx. 2.8x return on its three year old investment.

The next largest was the exit by Advent International from Care Hospitals via a sale to Abraaj Group for a reported $231 million. This was followed by Arpwood Partners’ stake sale in Senvion when it got listed in Frankfurt stock exchange on Mar 23, 2016 fetching a 2x return, within a year of the investment. In the IT space investors in BillDesk and Commonfloor registered exits in deals worth $100 M+.

Exits by Profitability

In Q1 2016, PE investors fetched 32 profitable exits compared to 52 profitable exits in the previous quarter. Of these, six exits fetched 3x or higher returns (compared to 13 such deals in Q1 2015).

SAIF Partners registered a 22x return in a buyback deal in JustDial, while Sequoia Capital India also recorded a 4.6x in a buyback deal in JustDial. Rakesh Jhunjhunwala's Rare Enterprises registered a 13x exit when it sold Concordia Biotech to Quadria India.

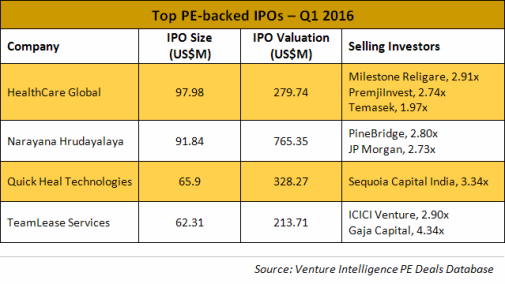

Exit Via IPOs

PE Backed IPOs during Q1’16 included those of

cancer care hospital chain HealthCare

Global, multi-specialty hospital operator

Narayana Hrudayalaya, security

software firm Quick Heal Technologies and

staffing services firm Teamlease

Services.

The full report has been mailed to Venture Intelligence subscribers. Please Contact Us for a trial.

Venture Intelligence is India's longest serving provider of data and analysis on Private Company Financials, Transactions (private equity, venture capital and M&A) & their Valuations in India. Click Here to Sign Up for the FREE Weekly Edition of the Deal Digest: India's First & Most Exhaustive Transactions Newsletter.