B2B Services, EdTech and IT Product Cos witness return of interest even as overall Venture Capital investments dip 32% in Jan-Mar'16

Venture Capital firms invested $242 million over 85 deals in India during the three months ending Mar 2016, data from the Venture Intelligence VC Deals Database shows. The investment activity by volume during Q1’16 is 32% lower compared to the same period in 2015 (which had witnessed 125 investments worth $471 million). The activity level was also 13% lower to the immediate previous quarter (which had witnessed 98 deals worth $347 million).

Note: As VC type investments cap out at $20 million per round under Venture Intelligence definitions, follow on investments raised by companies like BigBasket, CarTrade, ShopClues, Byju’s Classes, etc. are not included in this report.

The larger Growth Stage investments in Q1’16 included the $20 million Series D investment in B2B Group Buying site Power2Sme led by Nandan Nilekani (along with existing investors Kalaari Capital, Accel India and Inventus Capital) and the $13 million third round investment in baby products e-commerce site Hopscotch led by Facebook Co-founder Eduardo Saverin. Among Early Stage investments, food tech company Freshmenu raised $17 million from Zodius Capital and Lightspeed Ventures while Just Buy Live, a B2B marketplace connecting retailers with consumer brands, raised $14.5 million from Alpha Capital and Aarin Capital.

Information Technology and IT-Enabled Services (IT & ITES) companies, at 69 deals worth $199 million, attracted 79% of the investments in volume terms (83% in value terms). Food & Beverages companies followed a distant second attracting 3 investments worth $11 million led by beer maker Bira 91 which raised $6 million from Sequoia Capital India and angel investors. Sequoia Capital also led a $4.75 million investment in another beverages company RAW Pressary along with Saama Capital and DSG Consumer Partners.

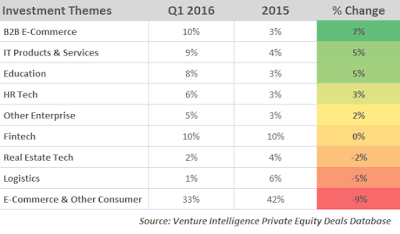

Even as investor interest in Consumer Internet & Mobile sectors like Food-Tech and Real Estate portals waned, Q1'16 saw the return of invest interest in sectors like B2B online services, Education and IT Products. Apart from Power2sme, other B2B services that raised capital during Q1'16 included Just Buy Live, KartRocket and SnapBizz. IT Product companies like Sedemac Mechatronics (mechanical engineering tech firm; $7.5 million led by Nandan Nilekani), Altizon Systems (IoT Startup, $4-M led by Wipro Ventures) and Aarav Unmanned Systems (drones for agri and industrial uses; $0.5 M from StartupXseed Ventures and others) and Ed tech start-ups Avagmah (B2B services in Higher Education; undisclosed amount from TechPro Ventures and Kris Gopalakrishnan), Mycity4kids (marketplace for after school activities; $3-M led by SIDBI Ventures) and FlipClass (Marketplace for tutors; $1-M from Blume Ventures and education publisher S Chand ) attracted capital during the period.

Comments? Join the Discussion on LinkedIn.

Venture Intelligence is India's longest serving provider of data and analysis on Private Company Financials, Transactions (private equity, venture capital and M&A) & their Valuations in India. Click Here to Sign Up for the FREE Weekly Edition of the Deal Digest: India's First & Most Exhaustive Transactions Newsletter.

Note: As VC type investments cap out at $20 million per round under Venture Intelligence definitions, follow on investments raised by companies like BigBasket, CarTrade, ShopClues, Byju’s Classes, etc. are not included in this report.

The larger Growth Stage investments in Q1’16 included the $20 million Series D investment in B2B Group Buying site Power2Sme led by Nandan Nilekani (along with existing investors Kalaari Capital, Accel India and Inventus Capital) and the $13 million third round investment in baby products e-commerce site Hopscotch led by Facebook Co-founder Eduardo Saverin. Among Early Stage investments, food tech company Freshmenu raised $17 million from Zodius Capital and Lightspeed Ventures while Just Buy Live, a B2B marketplace connecting retailers with consumer brands, raised $14.5 million from Alpha Capital and Aarin Capital.

Information Technology and IT-Enabled Services (IT & ITES) companies, at 69 deals worth $199 million, attracted 79% of the investments in volume terms (83% in value terms). Food & Beverages companies followed a distant second attracting 3 investments worth $11 million led by beer maker Bira 91 which raised $6 million from Sequoia Capital India and angel investors. Sequoia Capital also led a $4.75 million investment in another beverages company RAW Pressary along with Saama Capital and DSG Consumer Partners.

Even as investor interest in Consumer Internet & Mobile sectors like Food-Tech and Real Estate portals waned, Q1'16 saw the return of invest interest in sectors like B2B online services, Education and IT Products. Apart from Power2sme, other B2B services that raised capital during Q1'16 included Just Buy Live, KartRocket and SnapBizz. IT Product companies like Sedemac Mechatronics (mechanical engineering tech firm; $7.5 million led by Nandan Nilekani), Altizon Systems (IoT Startup, $4-M led by Wipro Ventures) and Aarav Unmanned Systems (drones for agri and industrial uses; $0.5 M from StartupXseed Ventures and others) and Ed tech start-ups Avagmah (B2B services in Higher Education; undisclosed amount from TechPro Ventures and Kris Gopalakrishnan), Mycity4kids (marketplace for after school activities; $3-M led by SIDBI Ventures) and FlipClass (Marketplace for tutors; $1-M from Blume Ventures and education publisher S Chand ) attracted capital during the period.

ET-Now's coverage of the quarterly trend:

Comments? Join the Discussion on LinkedIn.

Venture Intelligence is India's longest serving provider of data and analysis on Private Company Financials, Transactions (private equity, venture capital and M&A) & their Valuations in India. Click Here to Sign Up for the FREE Weekly Edition of the Deal Digest: India's First & Most Exhaustive Transactions Newsletter.