India is a frequent user of anti-dumping measures, having levied duties on 609 investigations since the inception of the World Trade Organization (“WTO”) in 1995. There have been several changes in the trend of anti-dumping duty investigations conducted by Directorate General of Trade Remedies (“DGTR”) recently.

Consolidation of trade remedy forums and creation of DGTR

- The Government of India, through an amendment to the Government of India (Allocation of Business) Rules, 1961 on May 7, 2018, has consolidated multiple trade remedial forums under the umbrella of the “Directorate General of Anti-Dumping and Allied Duties” (“DGAD”).

- The DGAD, previously in charge of conducting anti-dumping and anti-subsidy investigations, has accordingly been rechristened the DGTR.

- The amendment creates a single integrated authority which will oversee both outbound as well as bound investigations on various trade remedial measures such as anti-dumping, anti-subsidy, safeguards and quantitative restrictions.

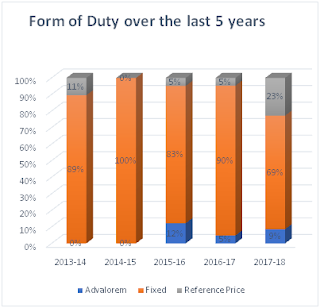

Greater flexibility on ‘form’ of duty

- Three forms of duties under the anti-dumping framework are ‘fixed duties’ (fixed duty in USD per unit); ‘ad valorem duties’ (a fixed percentage of duty based on value); and ‘reference price duties’ (duty being levied based on the difference between the benchmark and import prices).

- While India has historically favoured fixed duties for a majority of its anti-dumping levies, in recent times the Hon'ble Designated Authority has been considering different forms of anti-dumping duties at the time of recommending duties by way of final findings, in order to seek a balance between interests of all involved parties on a case to case basis.

Reduction in duration of duty levy to 3-years

- The DGTR has the discretion to impose duties upto five years.

- Since April 2017, there have been five separate cases (out of thirty-six investigations) where the DGTR has recommended duties only for three years, taking a balanced position between the interests of the domestic industry and the interests of the opposing parties.

- Prominent illustrations: Reference Price: MEK , Oxfloxin , O-Acids

Record ‘No Duty’ recommendations made by the office of the DGTR

- Since the year 2017-18, there has been a considerable increase in the proportion of cases where the DGTR has recommended ‘No Duty’ on at least one of the subject countries involved.

- The largest impact of ‘No Duty’ recommendations has been observed in sunset reviews in over 45% of the cases in the year 2017-18 and 100% thereafter (3 sunset reviews issued in April and May 2018).

- For the first time in the last five years, there were also four instances of the DGAD rejecting applications for sunset reviews in 2017-18.

Increasing focus on imports from Preferential Tariff Agreement sources such as Japan, Korea, Malaysia, Thailand and others

- With the signing of the various preferential tariff agreements, there has been a consistent increase in trade volumes and value between signatory countries. This has inevitably led to an increased focus on these countries during anti-dumping investigations.

- Once such example is the Japan-India Comprehensive Economic Partnership Agreement and its impact on Japan’s increasing prominence in India’s anti-dumping investigations – there has been an increase of approximately 300 % for anti-dumping investigations for imports originating in Japan in year 2017-18 when compared to previous year.

- At the same time, ‘No Duty’ results constituted 37.5% of these findings – consistent with the 36% ratio overall – which is promising.

- Prominent Illustrations:Hot Rolled flat products of alloy or non-alloy steel ,Caustic Soda

View the video of ELP Partner

Sanjay Notani on the latest trade related regulatory developments.