JM Financial and Kotak Mahindra Capital claim the No.2 & No.3 slots

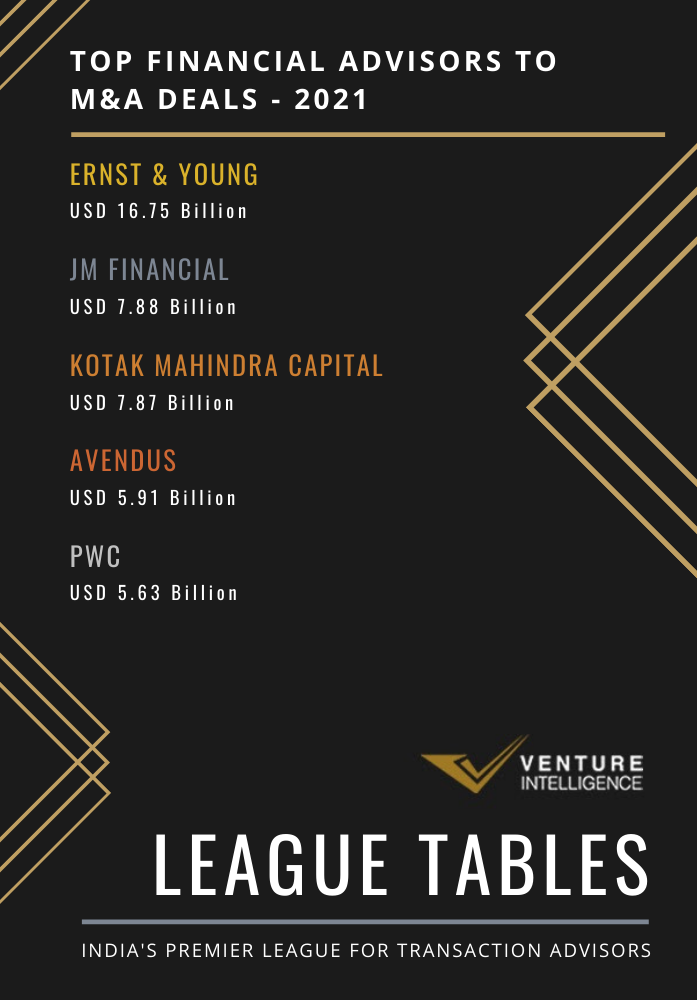

Ernst & Young (EY) topped the Venture Intelligence League Table for Transaction Advisor to M&A Deals during 2021, advising 39 deals worth $16.75 Billion. JM Financial ($7.88 Billion across 13 deals) and Kotak Mahindra Capital ($7.87 Billion across 8 deals) took the second and third spots respectively. Avendus ($5.91 Billion across 9 deals) and PwC ($5.63 Billion across 13 deals) completed the top five.

Among the larger deals of 2021, EY and Arpwood Capital acted as the advisors to the $5.2 Billion buyout of the Dewan Housing Finance or DHFL by Piramal Enterprises. Avendus, Kotak Mahindra Capital, and PwC acted as the advisors to the digital payments provider Billdesk's $4.7 Billion acquisition by Prosus-Ventures backed PayU. EY acted as advisor to Carlyle Group's acquisition of Baring Private Equity Asia's (BPEA) stake in Hexaware Technologies. JM Financial advised the $2.8 Billion bid by Blackstone to buy out a 75% stake in publicly listed MphasiS.

The Venture Intelligence League Tables, the first such initiative exclusively tracking transactions involving India-based companies, are based on the value of PE and M&A transactions advised by Financial and Legal Advisory firms.

Among the largest deals in the Oct-Dec quarter, EY acted as the advisor to the $2.4 Billion winning bid by Tata Sons for the national air carrier Air India and Advent International’s $1.5 Billion acquisition of IT Services firm Encora from Warburg Pincus. Goldman Sachs acted as the advisor to Reliance Industries’ $771 million acquisition of Norway-headquartered REC Solar Holdings from China National Bluestar (Group) Co Ltd. EY acted as the advisor to HSBC's $425 million acquisition of L&T Finance Holdings' mutual fund business unit.

Ernst & Young topped the table in terms of deal volume with 39 deals. They were followed by PwC and JM Financial in the second spot having advised 13 deals each. Avendus and KPMG took the third spot with 9 deals each. Veda Corporate Advisors and Kotak Mahindra Capital took the fourth spot with 8 deals each.

Including Other Advisory Services

Inclusive of its roles in due diligence and related advisory activities, Ernst & Young topped the tables with deals worth $47.77 Billion. PwC took second place having advised deals worth $31.22 Billion. KPMG stood third with deals worth $21.52 Billion. They were followed by RBSA Advisors ($16.36 Billion) and JM Financial ($7.88 Billion) in fourth and fifth spots respectively.

In terms of deal volume, Ernst & Young stood first with 167 deals. The second spot was held by PwC having advised 117 deals. KPMG took the third spot with 42 deals. BDO India and Transaction Square took the fourth and fifth spots having advised 41 and 27 deals, respectively.

The full league table can be viewed online at https://www.ventureintelligence.com/leagues.php

To showcase your firms' transactions in the 2021 League Tables, contact Vanathi at

About Venture Intelligence

Venture Intelligence is India's longest-serving provider of data and analysis on Private Company Financials, Transactions (private equity, venture capital, and M&A) & their Valuations in India.